Invoice instructions for timely payment of your invoices

Dear valued Supplier,

Extra Mile Materials BV has an ongoing policy to continuously improve efficiency and service quality to customers and suppliers alike, and as such we would like to inform you on our overall electronic strategy to move away from paper based financial transactions. Consequently, submitting your invoices via paper is no longer preferred but you are strongly encouraged to submit invoices by email without delay to ensure timely and accurate payments.

WHERE AND HOW TO SUBMIT YOUR INVOICE:

FOR SUPPLIER IN/FROM BELGIUM:

All invoices need to be sent via the PEPPOL network as of 1st of Jan 2026. For more details, see further.

FOR SUPPLIERS OUTSIDE BELGIUM:

PDF copy of your invoice should be submitted to suppliers@extramilematerials.com.

Note, this email address is only for invoice submission and are not manually monitored. Only invoices and attachments in accordance with below guidelines are transferred to our invoice processing system.

- Only 1 invoice (= 1 PDF) per email is allowed. Additional documents related to the invoice can be attached in the same email if relevant. If additional documents are attached, the file name of the invoice-PDF needs to be mentioned in the email subject text

- Invoice must be in PDF format and computer generated. Scanned images of hardcopy invoices cannot be accepted for tax compliance purposes

- Special characters are not supported in the file name

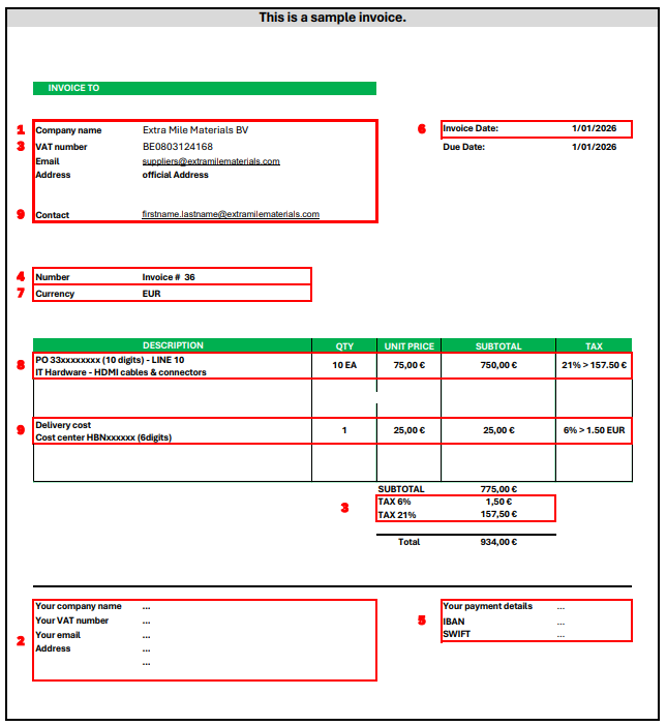

INVOICING REQUIREMENTS: See sample invoice below

When invoicing Extra Mile Materials BV for goods and services or when issuing a credit note, print all required information. Handwritten information will not be recognized.

- Extra Mile Materials BV Invoice address which can be found on the Purchase Order

- Supplier contact info (company name, address, email, phone number and Extra Mile Materials BV vendor number as indicated on your Extra Mile Materials BV Purchase Order)

- Supplier VAT number and Extra Mile Materials BV VAT number (BE0803.124.168), irrespective of VAT charged on invoice

- Invoices which are subject to domestic VAT are preferably issued in local currency

- VAT % and amount as separate line items

- Supplier invoice or reference number (related invoice number in case of credit note)

- Supplier bank details (including IBAN and SWIFT)

- The date of your invoice, which should never be before the date of the purchase order nor before the delivery of goods and services, unless otherwise agreed

- Invoice currency in iso-code (i.e. EUR, GBP, USD, PLN, DKK…) matching the issued PO

- Extra Mile Materials BV PO number and relevant line item

- Line item descriptions on the invoice must match the PO (item/PO line/description/Unit Of Measure and payment term)

- Different PO numbers on the same invoice are not allowed

- Extra Mile Materials BV contact name, email address and cost center if no PO is issued

If you do not know your Extra Mile Materials BV PO number, please connect with your Extra Mile Materials BV contact person prior to submitting your invoice.

If any required information is missing from your invoice, your invoice may be returned to you. If this occurs, you will need to correct the invoice and resubmit for processing.

WHERE TO GO FOR HELP:

For inquiries about invoice requirements and payment status contact finance@extramilematerials.com

This is a sample invoice.

Depending on the nature of the expense and country invoiced, additional details may be required.

Important Notice – E-Invoicing Transition for Belgian Suppliers

Effective 1 January 2026, Extra Mile Materials BV will only accept invoices from Belgian domestic suppliers via the Peppol network or the SAP Business Network (Ariba).

Please take note of the following guidelines:

- From 1

January 2026,

submission via Peppol or SAP Business Network Ariba becomes mandatory.

- Do not

send PDF invoices to our invoicing email addresses once you begin submitting

via Peppol or Ariba.

- Always include

the PDF invoice within the XML file to ensure timely processing and

payment.

- Always include

the usual email address in the XML file to support timely processing and

payment.

- Invoicing

requirements remain

the same as for the pdf sent invoices

- This

change applies only to Belgian domestic suppliers. Cross-border

suppliers are not impacted and should continue using existing invoicing

channels.

- Extra Mile Materials BV is registered on Peppol. Please ensure your systems are updated accordingly. (see below table)

If you have any questions, please contact us at: finance@extramilematerials.com

|

BE32 |

Extra Mile Materials BV |

BE0803124168 |

|